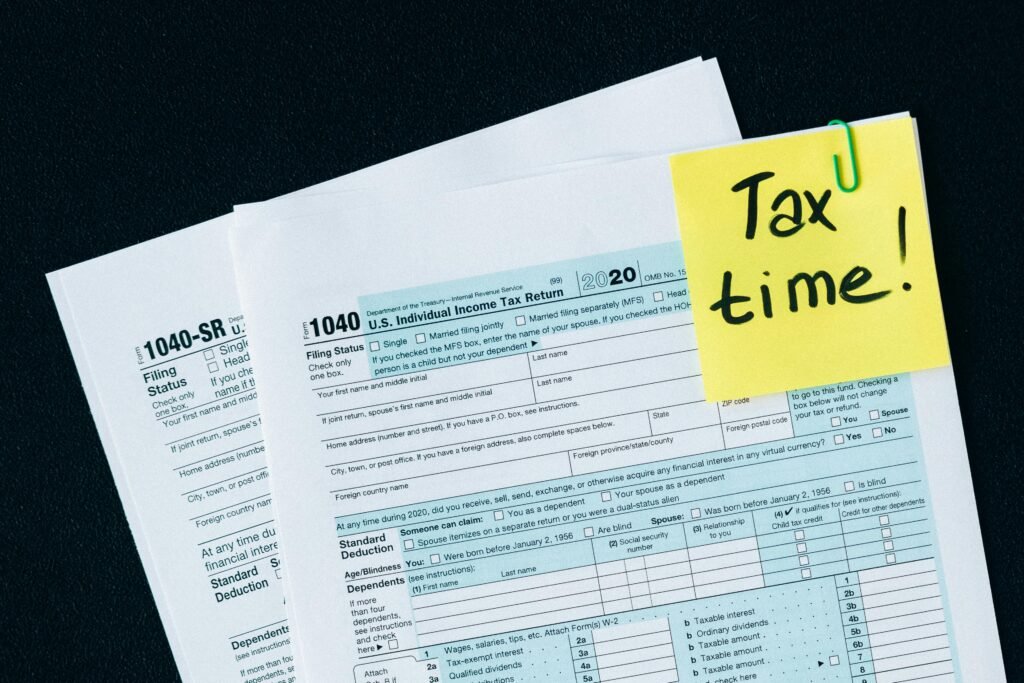

When it comes closer to the year 2025 Tax Brackets have been expecting certain shifts in tax legislation for instance on the issue of the tax rates. The tax rates which are applicable in any country explain the ration at which your income is charged where you are charged differently depending on your income status. Tax brackets also have the ability to change so any time there are changes they should be made known to the general public as well as have an understanding of how they will affect the general populace.

As we move deeper into this article, players will be able to understand more about tax brackets and learn more regarding the tax brackets expected for the 2025 tax season. We shall also see possible changes due to the recent tax legislation and how one should be prepared for it.

What Are 2025 Tax Brackets?

It is the scale of income that shows at what rate a given income is tax. In the U.S. System of federal taxes, everyone is tax at the same rate up to certain level of income then gradually increase. Taxable income can be divided into several ranges, with each range being taxed at a different rate, according the IRS. These brackets facilitate the fact that every member who earn more is expect to contribute more to taxes as compare to another with a lesser income.

Example of How Tax Brackets Work:

Let’s say the tax brackets for a given year are as follows:

- 10% on income up to $10,000

- 5% on income between $10 001 and $40000

- 18% in the income range of forty thousand five hundred and eighty five thousand, California borrow 22% on income of $40,001—$85,000.

- 24% on those income earners earning between $85 001 and $160 000.

- If for instance one earns fifty thousand dollars, or any other amount, one does not pay 22% on the total amount. Instead, you pay:

- 10% on the first $10,000

- 10% for the amount from $10 001 to $ 40 000.

- 21 percent on the portion from $40,001 to $50,000

This is because the only difference between the two is that the latter is express at a higher rate of tax for the extra income in the higher brackets to discourage the taxpayers on the aspect of earning more.

2025 Tax Brackets: What to Expect

The current tax brackets for the year 2025 propose are expect to harmonize with the framework that was set by the Tax Cuts and Jobs Act for the year 2017. The TCJA reduce most of the tax brackets and broaden the income slabs of each of them making taxes reduce for majority. Nevertheless, much of the provisions of the TCJA have design to apply only up to the end of December, 2025 and this will go a long way in changing the tax brackets.

Current Tax Brackets Under the TCJA

- 10%: For those filing as single, up to $11,000 and for married couples filing jointly up to $22,000.

- 12%: $11,001-$44,725 for single individual, $22,001-$89,450 for married persons filing jointly.

- 22%: $44,726 to $95,375 for single filers, $89,451 to $190,750 for joint filers.

- 24%: $95,376- $182,100 (single), $190,751 – $364,200 (marriage filing jointly)

- 32%: The standard deduction will range from $182,101 to $231,250 for singles while for married couples filing the deductions will range from $364,201 to $462,500Family.

- 35%: $231,251 to $578,125 for individuals, $462,501 to $693,750 for married individuals filing jointly.

- 37%: Single Alabama filers earning over $578,125 and joint filers earning over $693,750.

What Could Change in 2025?

If TCJA is allow to expire as it is silent on its expiration, one may find him or herself being answerable to some of the highest tax rates for most income brackets as was the position before the TCJA. This means that until Congress acts to preserved, or change the provisions of the TCJA the taxpayer may face a situation wherein their taxes will be increase from the fiscal year 2025.

Here are the potential changes:

- Higher Tax Rates: The highest marginal tax could go back to 39.6% while other bands go higher.

- Narrower Brackets: Tax brackets means the income slabs could be more compressed; this means that more of your income comes under the higher income tax rates.

- Reduction in Standard Deduction: The TCJA almost double the standard deduction; it could be lower, and this means more constraints on tax-free income.

What Congress Might Do

Again though, even the TCJA is set to expire, it is always possible that Congress might push through new impending legislation that will either maintain the current tax brackets or continue the alteration of the same. Tax policy is a big discussion on the political scene, and the future elections may lead to significant alteration, or no change at all in the tax brackets for the years in 2025.

Some potential actions include:

- Extending the TCJA Provisions: One way in which Congress could go was to extend the current tax brackets in order not to give a shock to the individuals and companies by the new rates of taxation.

- Passing New Tax Legislation: In view of the distinguishing characteristics of different political periods, new tax policies may be propose that would result in an increase in taxes or would imply reducing tax rates and the number of tax brackets or changing other provisions of the tax legislation, including deductions and credits.

A plan for the tax bracket in the year 2025

These ideas make it clear that if you want to know how tax rates in the year 2025 will be to you, then it’s time for you to plan. Here are a few steps you can take:

-

Stay Informed

The only way to plan for the taxes is to be inform on the subject with doing research or hiring a tax consultant. Follow any current tax reform discussions on Capitol Hill as your tax brackets may be affect by propose legislation.

-

Due Diligence on Investments That Are Tax Defer

If the idea is that taxes will rise in the future, that is the time to contribute more to a tax-shelter plan like a 401(k) or an IRA. Ideally, by lowering your taxable income now, it may be helpful in the future if there are any changes in the tax brackets that go into effect come 2025.

-

Least for Employee Tax Withholdings, these Deductions and Credits need to be evaluate

A very significant factor that can be use to its reduce the amount of tax that has to pay is deductions and tax credits. For example, the standard deduction may be different in 2025, that is why you have to decide whether it is more profitable for you to indicate itemized deductions.

-

Consult a Tax Professional

Again, if you are in doubt on how the new changes on the 2025 tax brackets may impact on you better consult a tax expert. They can also advise on how one can change his/her financial plan in view of alterations in tax legislation.

-

Track changes of Retirement and Estate taxes

It also means that individual income taxes could be next, as well as such essential components of taxation as the changes in retirement saving and estate taxes. It is also important to pay attention to the taxation of the documents an individual has signed for estate planning and how he or she invested for retirement.

Effect on Various Income Group

The expiration of the TCJA and potential changes to the 2025 tax brackets could have varying effects on individuals based on their income levels:

- Low-Income Individuals: Fewer so-call lower-bracket payers may not be significantly affect overall, yet they could also find their overall tax bite inch up if the standard deduction is lower.

- Middle-Income Individuals: Middle-income families were the primary winners of the TCJA’s lower rates, and they stand to face the largest tax hikes if the brackets go back to their pre-TCJA state.

- High-Income Individuals: The present highest tax could extend to 39.6%, hence it will affect the affluent business people or individuals if the parameters for the high-income earners are reduce.

Conclusion

For year 2025, it becomes important to factor in how the tax brackets may shift. Although the progression of tax legislation is unpredictable, it is possible to prepare for the worst and avoid terrible consequences of higher tax rates. In case the TCJA’s will expire or decisions on new taxes will be made – it is always best to be ready for a change.

FAQs

-

What is potentially capable if the TCJA expires in 2025?

The TCJA may end soon, and that can bring back some tax brackets that existed before 2017; tax rates increase then, and income brackets become more slimly carved.

-

Is standard deduction going to be adjust in the next year, that is, the year 2025?

The standard deduction might be lower in 2025 in case of the TCJA’s non-continuation, and this will rise taxable income among many people.

-

What should I do for the tax bracket adjustments that are expect to be made for the year 2025?

For possible future taxation, one should invest in tax sheltered IRA, one should know when legislators are altering laws and one should consult with the tax expert.

-

The current tax rates under the TCJA are in the following table below;

Current tax rates under the current Tax Cuts and Jobs Act or TCJA are as follows: 2024 tax bracket is 10%, 12%, 22%, 24%, 32%, 35%, 37%.

-

May Congress raise the current tax brackets?

However, Congress could also legislate new taxes, and return the current tax brackets to pre-TCJA laws after the tax cut expires in 2025.